What Is Monzo Bank? A Comprehensive Guide To The UK's Leading Digital Bank

Imagine this—you’re scrolling through your phone, and suddenly you stumble upon a buzz about Monzo Bank. You’re curious, right? Monzo Bank isn’t just another bank; it’s revolutionizing the way we manage our finances in the UK. This digital bank is making waves with its user-friendly app, innovative features, and a focus on simplicity. So, if you’re wondering what Monzo Bank is all about, you’re in the right place.

Monzo Bank has become a household name in the UK for its seamless digital banking experience. It’s not just an app; it’s a lifestyle change that’s helping people take control of their money like never before. With no physical branches and everything managed through your smartphone, it’s no surprise that millions of users have already made the switch.

But what exactly sets Monzo apart from traditional banks? And why should you consider joining the digital banking revolution? In this article, we’ll dive deep into everything you need to know about Monzo Bank, from its history and features to the benefits and potential drawbacks. Let’s get started!

Read also:Ahad Raza Mir And Sajal Ali Divorce Reason The Untold Story You Need To Know

Here’s a quick guide to help you navigate:

- The History of Monzo Bank

- Key Features of Monzo Bank

- Benefits of Using Monzo Bank

- Potential Drawbacks of Monzo Bank

- Monzo vs Traditional Banks

- Monzo Bank Security

- Pricing Plans and Fees

- Monzo for International Users

- The Monzo Community

- The Future of Monzo Bank

The History of Monzo Bank

Monzo Bank started its journey back in 2015, and it all began with a simple idea—why can’t banking be easier? Founded by Tom Blomfield, the company quickly gained traction for its innovative approach to financial services. Initially, Monzo launched as a prepaid card provider, but it soon evolved into a fully-fledged digital bank.

In 2017, Monzo received its banking license, marking a significant milestone in its growth. Since then, it has expanded its offerings, introducing current accounts, savings features, and even lending services. Today, Monzo boasts over 5 million customers in the UK, making it one of the largest digital banks in the country.

How Monzo Changed the Banking Landscape

Monzo didn’t just enter the banking scene—it disrupted it. By focusing on transparency, simplicity, and customer experience, Monzo has challenged traditional banks to up their game. Its rise has inspired other fintech companies to follow suit, leading to a more competitive and innovative banking environment.

Key Features of Monzo Bank

So, what makes Monzo Bank so special? Let’s break down its key features:

- Instant Notifications: Every time you make a transaction, Monzo sends you a notification right away. This helps you keep track of your spending in real-time.

- Pot System: Monzo’s Pot system allows you to set aside money for different goals, like saving for a vacation or an emergency fund.

- Overseas Spending: Traveling abroad? Monzo offers low fees for international transactions, making it a great option for globetrotters.

- Joint Accounts: Need to share finances with someone? Monzo offers joint accounts, perfect for couples or roommates.

- Monzo Metal: For premium users, Monzo offers a metal card with additional perks, such as travel insurance and cashback offers.

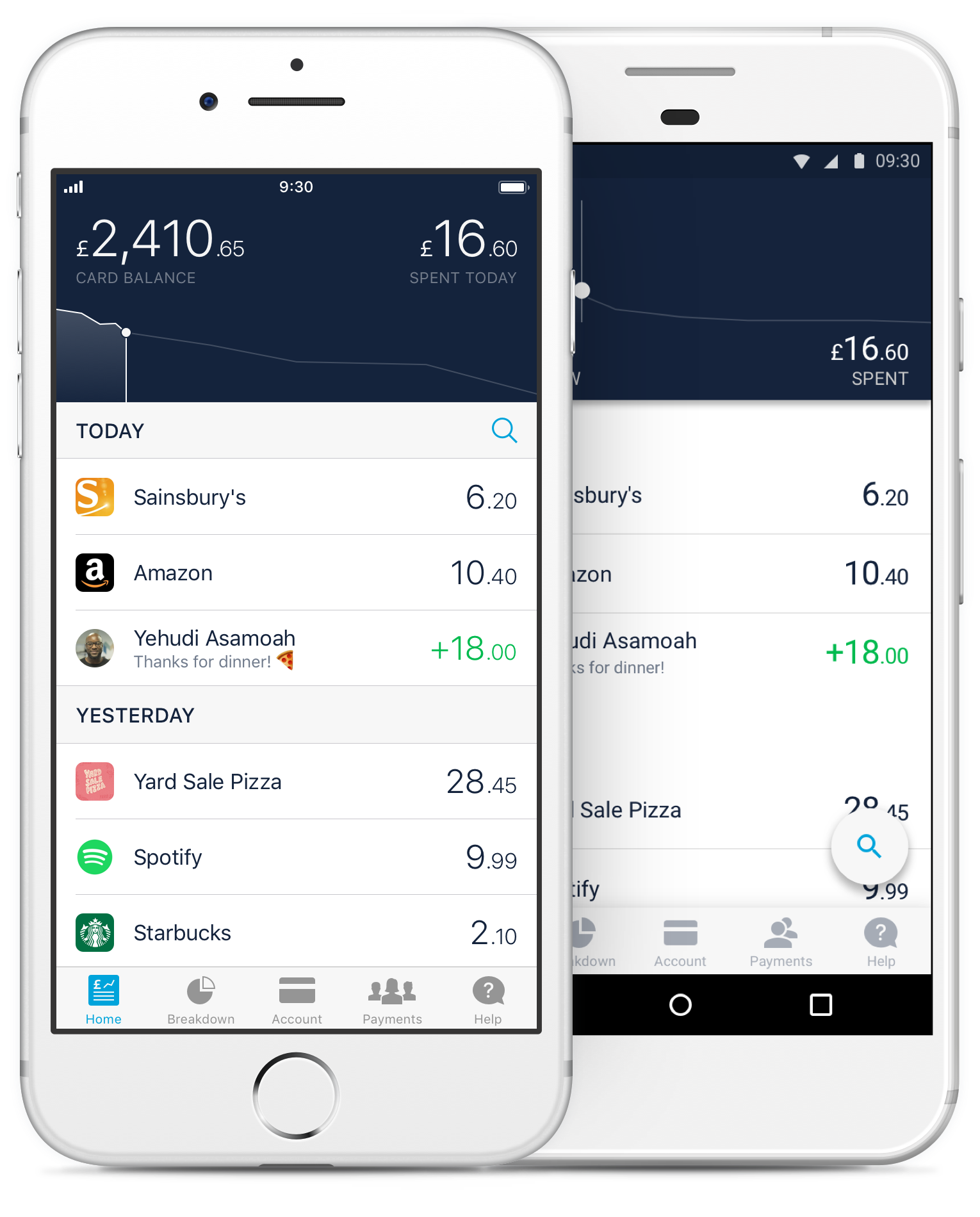

Monzo’s App: The Heart of the Experience

The Monzo app is where the magic happens. With its sleek design and intuitive interface, managing your finances has never been easier. From setting budgets to tracking expenses, the app puts everything at your fingertips.

Read also:Tennessee Brando Bio The Rising Star Taking The World By Storm

Benefits of Using Monzo Bank

Why should you consider switching to Monzo Bank? Here are some compelling reasons:

- Convenience: With no physical branches, Monzo lets you manage your money anytime, anywhere.

- Transparency: Monzo is known for its clear and straightforward approach to fees and charges.

- Customer Support: Monzo’s customer service is top-notch, with 24/7 support available through the app.

- Innovation: Monzo is constantly rolling out new features and updates to improve the user experience.

Monzo and Financial Inclusion

Monzo has made a conscious effort to include everyone in its banking revolution. By offering basic accounts with no credit checks, Monzo ensures that even those with poor credit scores can access essential banking services.

Potential Drawbacks of Monzo Bank

While Monzo Bank has plenty of advantages, it’s not perfect. Here are some potential drawbacks to consider:

- No Physical Branches: If you prefer face-to-face banking, Monzo might not be the right fit for you.

- Dependence on Technology: Since Monzo relies heavily on its app, any technical issues can disrupt your banking experience.

- Limited Savings Options: While Monzo offers savings features, its interest rates are relatively low compared to some traditional banks.

Addressing Common Concerns

Many people worry about the security of digital banking, but Monzo takes several measures to protect its users’ data. From two-factor authentication to fraud detection systems, Monzo ensures that your money is safe.

Monzo vs Traditional Banks

How does Monzo stack up against traditional banks? Let’s compare:

- Convenience: Monzo wins hands down with its app-based service, while traditional banks often require in-person visits.

- Fees: Monzo generally offers lower fees, especially for international transactions.

- Innovation: Traditional banks are often slow to adopt new technologies, whereas Monzo is always on the cutting edge.

Why Choose Monzo Over Traditional Banks?

Monzo’s focus on user experience and innovation makes it a compelling choice for anyone looking to simplify their financial life. Plus, its commitment to transparency and fairness sets it apart from many traditional banks.

Monzo Bank Security

Security is a top priority for Monzo Bank. Here’s how they keep your money safe:

- Two-Factor Authentication: Monzo uses 2FA to verify your identity when accessing your account.

- Fraud Detection: Monzo’s advanced algorithms detect suspicious activity and alert you immediately.

- Data Encryption: All your data is encrypted to prevent unauthorized access.

What Happens if My Card is Lost or Stolen?

Don’t panic! Monzo makes it easy to freeze your card through the app, and you can even order a replacement card instantly. Plus, Monzo offers fraud protection, so you’re covered if any unauthorized transactions occur.

Pricing Plans and Fees

Monzo offers several pricing plans to suit different needs:

- Monzo Free: Perfect for casual users, this plan offers basic features with no monthly fee.

- Monzo Plus: For £5 per month, you get additional perks like travel insurance and cashback offers.

- Monzo Metal: At £15 per month, this premium plan includes a metal card and enhanced benefits.

Understanding Monzo’s Fee Structure

Monzo’s fee structure is simple and transparent. While most transactions are free, there are some charges for services like international ATM withdrawals. However, these fees are generally lower than those of traditional banks.

Monzo for International Users

If you’re an expat or frequent traveler, Monzo is a great option. Its low fees for international transactions make it easy to use your card abroad. Plus, Monzo’s multi-currency accounts allow you to hold and spend money in different currencies without hefty conversion fees.

Monzo’s Global Expansion

While Monzo is currently focused on the UK market, it has plans to expand internationally in the future. Keep an eye out for updates if you’re outside the UK and interested in joining the Monzo community.

The Monzo Community

One of Monzo’s strengths is its vibrant community of users. Through its app, Monzo encourages users to share tips, ask questions, and provide feedback. This sense of community helps create a more personalized banking experience.

How to Get Involved

Whether you’re looking for advice on budgeting or just want to connect with other Monzo users, the app’s community features make it easy to get involved. You can also follow Monzo’s social media channels for the latest updates and insights.

The Future of Monzo Bank

Monzo’s journey is far from over. With plans to expand its services and enter new markets, the future looks bright for this digital banking pioneer. As technology continues to evolve, Monzo is well-positioned to lead the charge in reshaping the banking industry.

Monzo’s Vision for the Future

Monzo’s ultimate goal is to empower people to take control of their finances and live better lives. By continuing to innovate and listen to its users, Monzo is well on its way to achieving this vision.

In conclusion, Monzo Bank is more than just a bank—it’s a movement. With its focus on simplicity, transparency, and innovation, Monzo is changing the way we think about banking. So, if you’re ready to join the digital banking revolution, why not give Monzo a try? And don’t forget to share this article with your friends and leave a comment below—we’d love to hear your thoughts!

Article Recommendations